Audit Assertions for Purchases

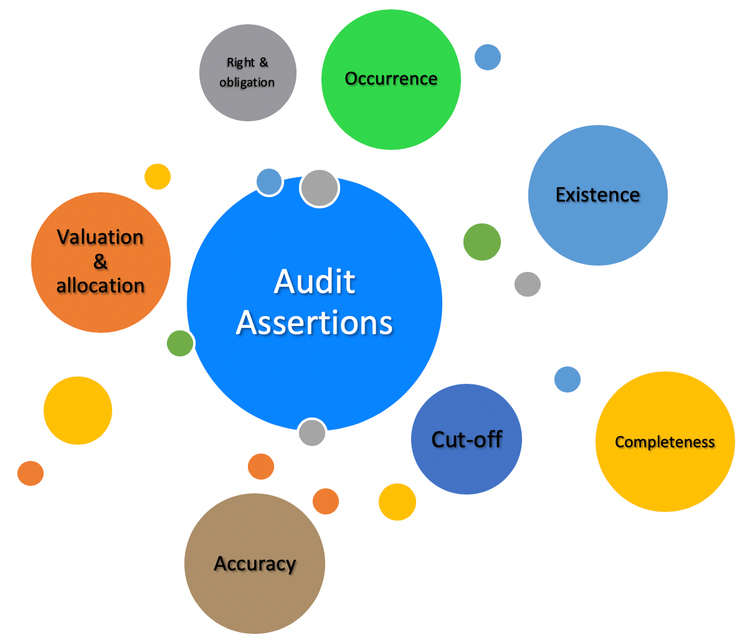

Completeness assertion in the audit of inventory tests whether all the inventory at year-end is included in the balance sheet and all purchases and sales of inventory are recorded. All businesses make assertions in their financial statements.

Audit Expenses Assertions Risks And Procedures Wikiaccounting

21st April 2019 Kamran Ullah Khattak.

. There are six assertions that relate to transactions and events and six assertions associated with account balances. For example when a financial statement has a cash balance of 605432 the business asserts that the cash exists. Make sure your financial statements are.

It seems to me the assertions you are testing for payable is not quite relevant to the assertions for the balance sheet balances. For transactions and events auditors need to verify the occurrence. Accounts Payable is an obligation that is incurred on companies in terms of.

In the audit of expenses completeness is the most relevant audit assertion in which we pay more attention to it. For example auditor may use the inspection procedure to test the occurrence assertion of expense transactions by vouching them to receiving reports suppliers invoice and purchase. In this regard it is important for auditors to realize the fact that there is a risk associated with purchases and audit procedures need to be designed in order to ensure that purchases along.

Audit Assertions are a representation by management that is embodied in the financial. I was taught that the relevant assertion tests for. Study Assertions for Purchasing and Cash Disbursement flashcards from Kathy Shelledys Nova Southeastern University class online or in Brainscapes iPhone or Android app.

This confirms that the entity has procured goods based on an. This is due to the lack of completeness will lead to the understatement of. There are four major auditing assertions that need to be tested during an audit process.

Audits may not be fun but they do provide value by verifying your internal controls and financial reporting are in proper working order. Step 1 Identify the assertion tested. Balance Sheet and PL assertions explained.

Accuracy is another audit assertion that concerns transactions and events. Hence it impacts the income statement. Audit procedures are performed in order to test financial statement assertions.

It relates to ensuring transactions recorded in the. The first step is to make a Purchase order or requisition and the demand for the ordering of goods should come from the respective department in writing.

How To Test For Completeness Of Purchases Or Expenses Universal Cpa Review

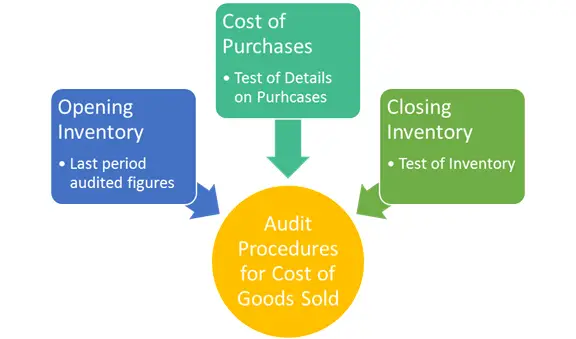

Auditing Cost Of Goods Sold Risks Assertions And Procedures Audithow

Comments

Post a Comment